On April 11, 2025, a vulnerability in the Morpho App frontend led to an incident involving $2.6 million in assets. The issue was confined to the Morpho App’s frontend, with no impact on the underlying Morpho smart contracts, which continued to function normally. Importantly, this was not the result of an exploit or hack, as no malicious actor was involved in the event.

Importantly, there was no exploit or hack; no malicious actor was involved in this event. There were only two parties: a user and a white hat. The user made a transaction through the Morpho App, which the white hat identified as having a potential vulnerability. The whitehat then intercepted this transaction to prove the vulnerability, reported it, returned the funds to the user, and received a bug bounty. No funds were lost.

Overview of the Morpho App Frontend Vulnerability

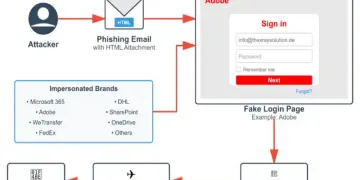

Contrary to early reports suggesting malicious activity, the event involved a white hat actor who intercepted an incorrectly crafted frontend transaction. The Ethereum address linked to the incident, c0ffeebabe.eth, did not execute a malicious transaction, but instead consumed a poorly crafted frontend transaction approval to secure the funds. These funds were then promptly returned to their rightful owner.

There was no theft or compromise of the smart contract or protocol itself. The issue arose solely from the frontend, which allowed an improperly constructed transaction to be processed. The white hat’s intervention was proactive, aiming to prevent any potential loss rather than exploiting the vulnerability for personal gain.

Conclusion

The Morpho App frontend vulnerability incident highlights the critical importance of secure frontend implementations in decentralized finance (DeFi). While initial reports caused concern about a possible protocol-level breach, the issue was identified as a flaw in the frontend, particularly related to a Bundler3 contract, not a vulnerability in the Morpho protocol or its smart contracts.

Crucially, no funds were stolen by malicious actors. Instead, a white hat acted responsibly, intercepting and correcting the flawed transaction, ensuring that the assets were returned to their rightful owner. This event highlights the need for rigorous security measures at all levels of DeFi platforms, particularly to protect users from vulnerabilities at the frontend.